Accounts that have not been made transferable or payable on death.Upon the death of a decedent, assets must transfer into a trust (like a testamentary trust).Personal property with high value, including jewelry, artwork, and vehicles.Ownership of the decedent’s portion of assets as tenants in common.The following are examples of assets typically subject to probate: Usually, the executor must file probate on these high-value assets that meet these qualifications, as well as any assets that a will instructs to pass into a trust upon an individual’s death since the trust doesn’t yet own the assets. Property subject to probate is untitled property, does not have a beneficiary designation, or the deceased solely owns, or jointly owns it with another individual as tenants in common. You can’t avoid probate by making a will, but the terms can guide the process, and not all wills need to be probated at all.If you become the personal representative of an estate, you can initiate probate by filing a petition with the court.Probate laws vary from state to state, and most states allow you to avoid it under certain conditions.

#Qualifications for a sc pribate jydge how to#

There may still be probate in the absence of a will because the court must establish how to distribute the assets of the deceased’s estate to their loved ones. The probate process involves proving the will is legitimate (verifying that it is a legal document). Most people write a last will and testament to state their wishes and instructions regarding their estate.

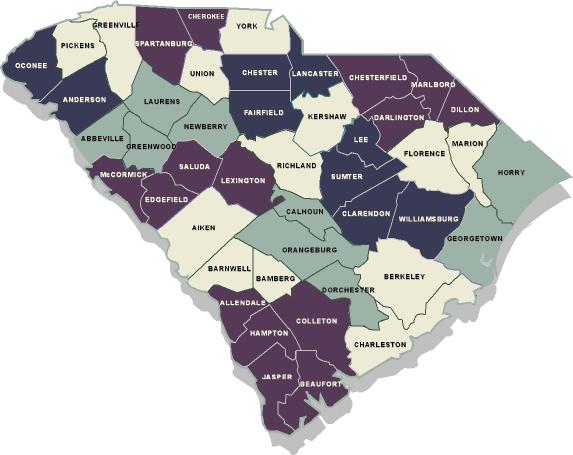

As part of this legal process, the probate court will validate the decedent’s last will and testament, distribute assets to the heirs, and settle all debts. Probate is the process by which assets of an individual, known as the decedent, who recently passed away, transfer to the individual’s heirs. How Do Probate Laws Work in South Carolina ? Executors and administrators of an estate can consult a probate attorney if they need legal advice or assistance. In the event that a person dies without a will, the surviving spouse or adult child usually has priority to open a probate case as the administrator. While it’s possible to handle some filings and matters entirely electronically, the court may require representatives and beneficiaries to physically appear in court at a courthouse if there’s a dispute or legal challenge or clarification is necessary. Probate is the legal process of settling a deceased’s affairs in an organized fashion.Įxecutors usually oversee probate through the probate court, which may also be called the superior court or surrogate’s court, depending on your state. This is where probate comes in.įamily members and loved ones can’t usually just descend upon the estate to take what the deceased left behind (even if the will states they are entitled to certain assets) or ignore all the matters an individual left unresolved. When someone dies, survivors must do certain things such as arranging a funeral or obtaining a death certificate, and figuring out what to do with all the loved one’s belongings, both tangible and intangible, such as bank accounts, mortgages, and more. Here’s what heirs should know about probate after the loss of a loved one, as well as what people who are making their own estate plans ought to know about avoiding probate. Although the probate process has a bad reputation, it is the reality for a significant number of families, and it’s a process that can function well for some small estates. Probate is the legal process of settling a deceased’s affairs in an organized fashion.

0 kommentar(er)

0 kommentar(er)